#015: On Diversification

Like the word ironic, it's a concept everyone uses but few people really understand.

Diversification is a term that is very frequently used in the world of money and investing that people can sometimes forget that they don't know exactly what it is, how it works, or whether they're doing it right. Like the word ironic, it's a concept everyone uses but few people really understand.

Imagine that you’re walking down the street, minding your own business, when all of a sudden you walk past a big candy shop, the kind where you can scoop the candy out of bins and fill up a plastic bag full of sugary treats and then pay by weight. The neon glow of the gummies and candies are a visual siren song, and the indomitable need for sugar suddenly overwhelms you.

You could fill the bag with just jelly beans, but what if they have deceptive flavors like mint peanut butter or, God forbid, banana? The Coke-bottle-shaped gummies look appealing, but what if they’re too waxy? What if the chocolate bites are too chalky? Sampling the wares before purchasing is pretty frowned upon, so you do the following: You fill your bag up with some safe bets, like gummy worms and sour bears, and then throw in some wild cards, like the weirdly shaped marshmallow bits or the strange purple jelly beans. That way, if one pick ends up being a miss, you’ll still have plenty of other candies in your bag to shuttle you towards your next cavity. And just like that our dear reader, you’ve practiced diversification.

Diversification is a technique that reduces risk by allocating investments across various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event.

But Beware!

It is not only important to know what diversification is, but it is also important to know what diversification isn’t. Keep the following important points in mind:

Don’t think that if you diversify you will never lose money. Diversification helps reduce your losses but does not completely prevent them.

Diversification is ideal for the long term. That means it may not help reduce short term downtrends in your investments.

Diversification is not a seesaw that investments ride! That means it isn’t necessary that if one investment goes up, another should come down.

What Does Diversification Mean in Investing?

Diversification is a strategy that aims to mitigate risk and maximize returns by allocating investment funds across different vehicles, industries, companies, and other categories.

That way, if, say, cryptocurrency ends up being more of a bust than a boom, you’ll probably be relieved that only 4% of your portfolio was invested in that area, and that your investments are bolstered by the presence of blue chip companies and investments in areas as diverse as real estate, bonds, and energy. If, however, 60% of your portfolio is invested in cryptocurrency, then a bust won’t just sting—it can mean serious financial losses.

What Happens When You Diversify Your Investments?

When you diversify your investments, you reduce the amount of risk you're exposed to in order to maximize your returns. Although there are certain risks you can't avoid, such as systemic risks, you can hedge against unsystematic risks like business or financial risks.

Diversification can help an investor manage risk and reduce the volatility of an asset's price movements. Remember, however, that no matter how diversified your portfolio is, risk can never be eliminated completely.

You can reduce the risk associated with individual stocks, but general market risks affect nearly every stock and so it is also important to diversify among different asset classes. The key is to find a happy bridge between risk and return. This ensures you can achieve your financial goals while still getting a good night's rest.

Levels Of Diversification

There are three broad levels that diversification can be classified into.

Diversification within investments – Let’s assume you owned only one stock. If that company does well, you get good returns. But, what if the company shuts down? Your investment goes for a toss. So, what do you do? You buy stocks from different companies to avoid such situations.

This is known as diversification across investments. Mutual funds do this for you by buying different stocks and managing them.

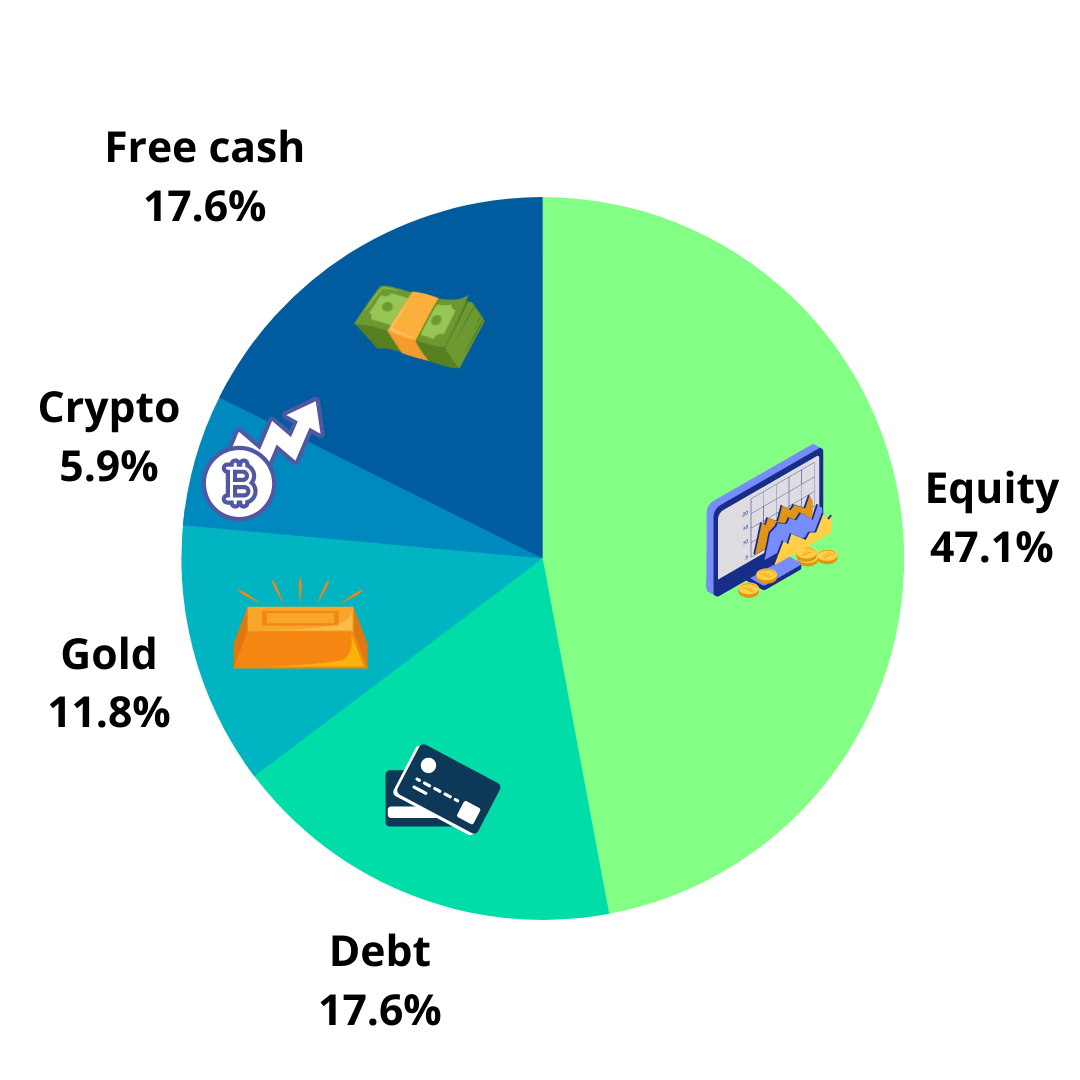

Diversification across types of assets – The three main kinds of assets are equities, debt and cash. Asset allocation is diversification across different types of assets. By determining your asset allocation you reduce investment risks.

But, what happens when you own a mix of equities and bonds? Bonds or debt investments have a lower risk and give lower returns when compared to equity investments.

So, investment in bonds will make up for any losses you might incur by investing in equities. Equities have good growth potential, which is why you needn’t worry about getting lower returns from debt investments. All you need to do is get your asset allocation right.

Diversification by sub-asset types – Stock is an asset class. So, what exactly would be termed a sub-asset? Well, large-cap stocks, mid-cap stocks or small-cap stocks would be sub-asset classes. Similarly, debt is an asset class. Bonds, Government securities and Fixed Deposits would be sub-asset classes. So, it is not only important to invest across asset classes, but also across sub-asset classes.

What Is an Example of a Diversified Investment?

A diversified investment portfolio includes different asset classes such as stocks, bonds, and other securities. But that's not all. These vehicles are diversified by purchasing shares in different companies, asset classes, and industries. For instance, a diversified investor's portfolio may include stocks consisting of retail, transport, and consumer staple companies, as well as bonds—both corporate- and government-issued. Further diversification may include money market accounts and cash.

To sum up, diversification is not a goal in itself. It has its downside and increases your paperwork as an investor. In fact, We would go so far as to call it a necessary evil. One should do the minimum required and no more. Beyond that, it's worse than useless.

Furthermore, the rationale is that in the long term, a diversified portfolio consisting of various different assets can yield more consistent growth than individual assets alone. So diversification can definitely be an appealing investment strategy for all investors.

And if you’ve spent any time with us, you’ll probably know by now that we’re pretty partial to it as well.

That’s it for today dear reader. See you next week.

If you liked what you read, do subscribe and share with people who can benefit from this. You can also follow us on Twitter/Instagram: @osafarnama and @ashwinkatyal77