#013 On Cognitive Bias: Part IV

How the fear of loss outweighs the satisfaction from gaining and How being too optimistic has its consequences.

Human brain is powerful and there is no iota of doubt surrounding this statement. From inventions that changed the world to theories that shaped our political systems, human brain is capable of accomplishing a lot.

However, our brain still has certain limitations, as it tends to simplify processing of information. This makes our brain susceptible to certain cognitive biases that help you make sense of the world and reach decisions with relative speed.

A cognitive bias is a flaw in your reasoning that leads you to misinterpret information from the world around you and to come to an inaccurate conclusion.

Before starting, if you missed the previous editions of our Cognitive Bias series you can read them here: Part-I ,II and III.

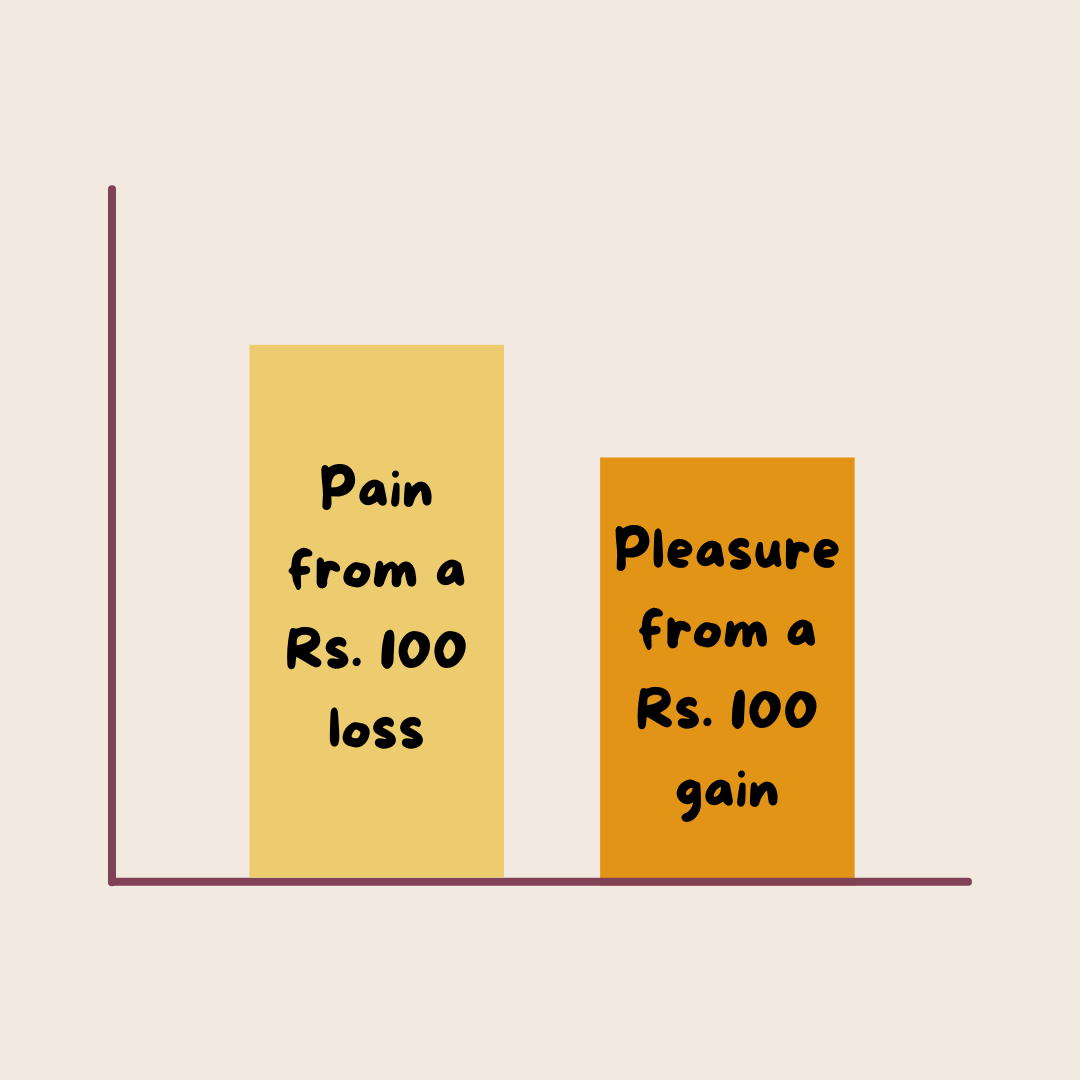

If you contemplate, psychologically, humans can’t stand being deprived of things and will over react in ways to avoid the pain of deprivation. For example if you lost ₹100 that pain would hurt more than the satisfaction you get from earning ₹100. That’s why fear is such a powerful emotion.

This phenomenon is better known as Loss aversion.Loss aversion is the observation that human beings experience losses asymmetrically more severely than equivalent gains.

Loss aversion relates to how humans would rather avoid a loss than receive any sort of gain, even if it’s the same exact outcome.

This cognitive bias becomes more powerful as the bigger your investment gets. What’s crazy is it doesn’t only relate to financial investments. It comes into play with emotions, time, life, safety, resources.

This overwhelming fear of loss can cause investors to behave irrationally and make bad decisions, such as holding onto a stock for too long or too little time. For instance, many investors do not square-off their position even though the stock is continuously declining, as they fear booking losses and hope for a turnaround. In some cases, that might happen but in majority of cases, this philosophy increases the losses which could have been limited had the investor booked out at an earlier stage, when enough red flags were visible. (Take the infamous case of Yes Bank as an example)

Ways to Combat this Cognitive Bias

There are some simple ways to allow yourself to combat the stranglehold that loss aversion has on our lives. We recommend incorporating these into your decision making process:

Don’t think savings. When there’s a ₹1,000 item on sale for 40% off, you didn’t save 40%. You still spent ₹600. Thinking differently can get you to understand value. If you think about it, all prices are made up. Some companies set their prices way higher to be able to discount more. It’s called high/low pricing. Watch out for it.

Stopping thinking in terms of scarcity. Ultimately, there will be more sales, clothes, food, promotions, etc. The quicker you get yourself out of this mindset, the quicker you’ll have more control over your decision making abilities.

Learn to move on. One of the best things to learn to do is knowing when to walk away from a decision. Don’t mull over recoverable losses. Failure is apart of everyday life. Learn from those mistakes and come back stronger than ever.

Think big picture. Keep in mind that gaining can be just as powerful as avoiding a loss. Too many people play defense especially when it comes to finances. Most successful people attribute playing offence to their financial success.

Be well informed: if your investment is continuously declining, look for red flags immediately. If enough red flags exist, it's better to bite the bullet and book out at a small loss, than booking out at a huge loss later.

As humans, we have a tendency to overestimate the likelihood of experiencing positive events and underestimate the likelihood of experiencing negative events.

That’s all well and good in ordinary circumstances: Such an outlook increases positivity and reduces anxiety, contributing to good physical and mental health. But it’s less so during a pandemic, when our tendency to emphasize positive outcomes could be putting ourselves and others at risk.

Underestimating the risks

The optimism bias phenomenon is a result, in part, of our tendency to imagine more vividly positive future events, and subsequently attribute more probability to them. Such susceptibility also offers scope for people to change their mindset.

Human brains have a built-in optimist bias. We believe that bad things can't happen to us. That's why we drive without a helmet, cross signals without looking, and clearly, a lot of us also believe that the virus won't get us. We often overestimate positive outcomes.

While investing, this particular bias can do more harm than good. As humans, we often get emotionally attached to our asset classes which are meant for sound purpose of investing. However, if there is an asset class, which has not been fetching the required rate of return and an investor continues to hold onto it only because they believe that nothing can go wrong with their investment thesis and when this bias is coupled with emotional attachment of an asset, it's a sure shot recipe for disaster, as the investor will completely negate the negative side of their investment which is responsible for low returns.

Some key takeaways for Decision-Makers

Use other biases to limit the effects: This bias is particularly important for decision-makers creating health or safety products, where the dangers of being overly optimistic can lead to dreadful outcomes. Hospitals, Nuclear power plants and oil refineries good examples. There are two researched ways of reducing the Optimism Bias: Highlight the Availability Heuristic (make past bad events more easily retrievable from one’s memory) and use Loss Aversion (highlight losses that are likely to occur because of these bad events). Incorporating these two concepts into product design or marketing collateral can go a long way towards helping reduce the risks of this bias.

Make negative events obvious: Bringing negative events to our mind just before we’re likely to engage in an undesirable act can be a good behaviour change technique, think what can go worng with your investment in a particular asset class. Germany’s “piss screens” are an interesting example of this suggestion - no kidding, they’re really called that. The product developers teamed up with Frankfurt’s taxi services to produce a game that would help reduce drink-driving by persuading drunk drivers to take taxis home instead. They decided to place these urinals in bathrooms, and designed them such that each urinal controls the car. The more drunk you are, the slower you drive, and the game ends with a crash, and a prompt to take a taxi home instead. The aim here is to make the negative effects of a certain action clear to the individual, and offer a clear, safer alternative. Even though a “piss screen” example may not be applicable, the intention with which it was designed has clear, powerful takeaways that you should factor in to your design.

That’s it for today dear reader. See you next week.

If you liked what you read, do subscribe and share with people who can benefit from this. You can also follow us on Twitter/Instagram: @osafarnama and @ashwinkatyal77