#005: On savings

Do you know that the world grew its "energy wealth" not by increasing the energy resource it had but by decreasing the energy it actually needed?

During the 1970s, globally we were running out of oil reserves as the economies were booming and the amount of oil we could auger couldn't keep up with the demand. However, we didn't actually run out of oil. The reasons were not just confined to exploring more oil or rather increasing drilling efficiency, but rather sustainability which had a key role to play. Interesting data points out that oil and gas production in the US has increased 65% since 1975, while conservation and efficiency has more than doubled. It is evident that the latter had a bigger role to play. But there’s still a long way to go in order to achieve optimum sustainability.

Extrapolating this with income and savings suggests that it is relatively difficult to control the amount of income one receives, just like production of oil depends on geography, weather, time, etc. However, becoming more efficient with our income, just like the world became with oil, is largely under our oversight. The decision to buy a car worth 10 lakhs or a car worth 5 lakhs has a 100% chance of improving efficiency.

Savings and thriftiness, are parts of the money equation that are more in your control and have a 100% chance of being as effective in the future as they are today and the fact that there's so much effort put into one side of the finance equation, the other equation becomes an opportunity for most people.

A high savings rate means having lower expenses than you otherwise would, and having lower expenses means your savings go farther than they would if you spent more.

There are so many ways to distribute your money on a monthly/weekly basis. One way is by percentage. This allows us to budget with varying amounts each month.

Finding a budget that works for you means trying out a variety of formats.

Irrespective of how do you budget, keep this in mind-

EARN FIRST. SAVE NEXT. INVEST. THEN SPEND.

The savings, if invested wisely with discipline for years opens the door for Financial Independence.

In personal finance, the margin of safety lies in high savings. By savings, you’re buying more choices for your future. This is could be understood by the concept of intertemporal choice in economics.

Types of Bank Accounts and Deposits

Savings Bank (SB) Account

• Low interest, however, highly liquid

• Facilitates payment mechanism through Automated Teller Machines (ATMs)

• No Tax deducted on Source (TDS) on interest on SB account balance, but taxable in the hands of depositor.

• Accounts can be opened in single name or joint names. In the case of a joint account, the operation of the account can be by any one or done jointly. The accounts can be opened in the name of minors also wherein the accounts can be operated by guardians.

Fixed Deposit (FD) Account

• Involves placing funds with the bank for a fixed term at a certain interest rate Interest on FD is subject to Tax Deducted at Source (TDS)

• Senior citizens may get extra benefit on the interest rate.• Tenure and rate of interest on FDs varies from bank to bank.

Recurring Deposit

• A fixed amount is deposited at monthly intervals for a predetermined term• Earns higher interest than savings bank account

• TDS applicable on interest accrued or earned

Special Bank Term Deposit Scheme

• Tax savings scheme available with banks

• Relief under Section 80C of the Income Tax Act, 1961

• Term deposit of five years maturity

• No premature withdrawal allowed

Four ways to make savings as easy as possible

1) STEP OFF THE CONSUMPTION WHEEL

Saving becomes a lot easier when you step off the consumption treadmill.

You need to separate what you need vs short term desires. Think about what you need vs what you want.

Advertising means that sometimes we can get what we need and what we want mixed up.

If something costs ₹1000, and it is on sale for ₹750 and you decide to spontaneously buy it, you did not save ₹250, you spent ₹750.

2) SET UP DIRECT DEBITS

This can be a direct debit after you get paid or every 2 weeks. Automate your savings so you don’t have to think about it.

We recommend using an online personal ledger as it is easy to set up savings pots and scheduled payments.

3) EDUCATE YOURSELF

There are so many ways to can educate yourself on a daily basis. Listen to podcasts, watch YouTube videos or follow educational accounts on Instagram (or you can subscribe to us as well haha).

This doesn’t have to be traditional education like reading books.

4) TREAT YOURSELF

Last, but not least...spend your money. Nothing is more motivating that the idea that you treat yourself. Reap the rewards of your hard work. Saving should not be without treats! Being frugal is a lot harder when you cannot reap any rewards.

This can be a Starbucks coffee or that sneaker from Nike you wanted.

Five different savings accounts everyone needs

• Emergency fund: at least 3-6 times your monthly expenses (more if you have kids or other major financial responsibilities)

• Short-term savings: for short-term money goals, like the big vacation you want to take next year!

• Recurring expenses: money you set aside to cover that spending that always sneaks up on you -- like holiday gifts and travel or your annual credit card fee.

• Long-term savings: for your major long-term money goals.

• "Just for fun" savings: lowest priority for a reason, but still important - any "leftover" savings you can put towards last minute fun purchases!

How to save when you don’t have enough to save?

Before you leave

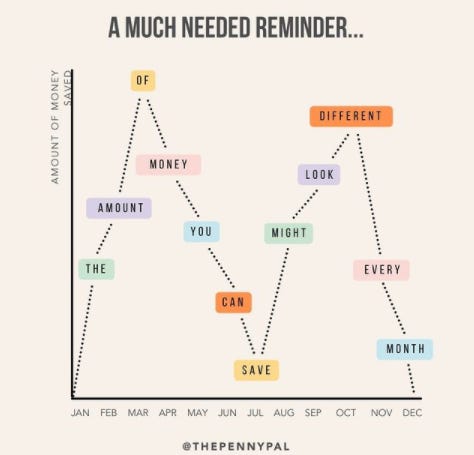

Saving money is the most boring advice, but this is the whole foundation on which everyone’s life is built. The percentage of income you are able to save is more important than the percentage of return you get. This is more true in the early part of your career. High income does not lead to wealth. it is high savings. But, yes, here is a much needed reminder before you leave…

Author’s Note:

Hi, if you liked what you read, do subscribe and share with people who can benefit from this. You can also follow us on Twitter/Instagram: @osafarnama and @ashwinkatyal77